Payroll services

Mazars comprehensive payroll services are focused on supporting our clients to be compliant, be able to make the right decisions for its employees and reduce workloads.

Our highly trained team of payroll professionals is led by Luís Batista and Patrícia Cardoso. We believe that our team of payroll experts who have a strong focus on client service enable our clients to navigate the requirements and complexities of Portuguese payroll.

Our payroll expertise

- Excellent communication in Portuguese, English, French and Spanish;

- Working with regional and global HR functions located outside of Portugal;

- Processing payroll with time and attendance data;

- Working within tight deadlines;

- Providing a one-stop service including accounting, tax compliance and work permit and visa services.

Implementation

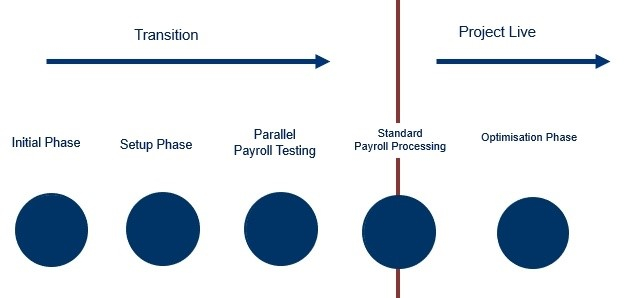

Mazars has significant experience in the implementation of payroll. During this critical period, our responsibilities are:

- Set up the employee database;

- Set-up procedures;

- Test the payroll process;

- Eliminate errors and incorrect settings;

- Perform a sample test (if required).

The transition process will be based on a detailed transition plan that would be agreed with our client.

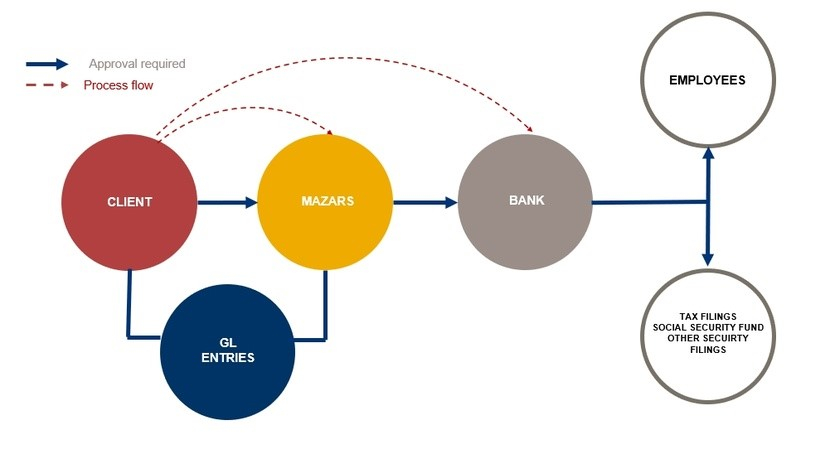

Monthly Payroll Processing

Mazars will assign each client to a dedicated team led by one of our experienced payroll managers and seniors.

- Our payroll services can be organized as follows:

Admission of new employees |

|

Monthly Payroll Processing

|

|

Termination of contract |

|

Annual Obligations

|

|

Other tasks

|

|

Reporting

Monthly Payroll Processing

- Showing, for each employee, the following: basic salary; additional income; deductions; withholding tax payable; employees SS contribution; work compensation fund contribution; net salary payable;

- Details of the staff that have resigned, terminated or joined client that month.

Payroll Withholding Tax Form (“DMR”)

- To be generated electronically and submitted by Mazars on behalf of the client.

Social Security (“SS”)

- Registration and qualification of workers in Social Security;

- It is generated electronically and submitted by Mazars on behalf of the client to DMR for Social Security, as well as its timely communication to the Company for payment.

Work Compensation Fund (“FCT”)

- Administrative tasks related to admissions, dismissals and other changes to salaries are ensured;

- Contributions from Companies and employees are generated and validated on the FCT - Work Compensation Fund website.

Other

- Making files available for integration of salaries in accounting, with the possibility of adapting to the client's needs.

On an annual basis

- Income statements;

- Single Report.

Quality Control

Mazars have documents all payroll workflows which are tied into detailed schedules that identify potential risks during all aspects of the payroll processing.

These controls and processes cover:

- New client implementation;

- Monthly payroll processing;

- Payment processing;

- Admissions and dismissals;

- Year-end processing;

- General controls;

- Client approval.